Give Us Some Credit

Credit cards were our first gateway to a cashless society—but magnetic stripes didn't always rule the day. Here's how credit cards have evolved.

Department stores once gave people metal plates to track credit

Carrying around a bunch of loose money at a department store isn’t the world’s greatest idea, and it definitely wasn’t that way back in the early 1900s, when department stores first started handing out metal plates to track a user’s spending against their credit at the store. The coins were imprinted using ink to track the amount spent, along with the person’s address.

The concept was a slightly more formalized version of what was being done during the general store era: Writing the person’s information into a ledger. If the person didn’t pay up, a debt collector would likely show up at the person’s house. Unlike nowadays, when debt collectors flood your mailbox and won’t stop calling you, these debt collectors usually drove up to your home in a horse cart, with the words “debt collector” written on the side, and took your stuff back. Not exactly subtle—and if you’re being targeted by said debt collector, pretty embarrassing.

But metal charge plates, which either looked like dog tags or tokens, had a bit of status-symbol appeal. Often given leather cases, the devices have a nice vintage look, which means you can find them on eBay or Etsy, often selling for the low tens of dollars.

“These store cards were accepted only at locations affiliated with the issuer of the cards in a limited geographic area. When a consumer traveled to another part of the country, the convenience associated with these cards was lost.”

— Stan Sienkiewicz, a then-researcher with the Federal Reserve of Philadelphia, discussing the fatal flaw of early credit offerings like metal charge plates in a 2001 report on the history of the credit card. The stores actually liked this, however—because it tied consumers to that specific store, ensuring that there was baked-in loyalty.

Five small innovations that led to the modern day credit card

- In the 1920s, the oil industry—particularly Texaco—began offering paper cards to its customers—important for fueling up. Their cards helped set the standard playing-card size for today’s credit cards.

- The Air Travel Card, an American Airlines-issued card that’s considered the first “charge card” in history, was the first to include a numbering system to track a specific card user. First launched in 1936, the card became tied to airlines for decades to come.

- In 1958, Bank of America created its first credit card, the BankAmericard. The card is notable not just for being one of the first to be launched by a bank, but for helping to create a network of other banks that could offer cards of their own. By the 1970s, the card service was spun off, and it became better known as Visa. Mastercard came along in 1966 as the Interbank Charge Association.

- In 1969, the Air Travel Card, already an innovator in the space, became the first card to include the magnetic stripe, which was invented by IBM in the 1960s. It took until 1980 before the technology became palatable for mainline credit card providers.

- In 1984, the online service Compuserve began offering an Electronic Mall to its members. This service effectively became the first major online shopping service, and—by proving that credit card numbers could be transferred electronically—set the stage for Amazon and company to come along a decade later.

20k

The number of people who were using Diners Club credit cards by the end of 1950, after the cards were introduced in February. The cards, which required users to pay their restaurant bills at the end of each month, represented the first kind of credit card that wasn’t tied to one location. A common story around the Diners Club is that the company’s founder, Frank McNamara, forgot to bring money with him to a restaurant, but that’s largely considered a made-up parable.

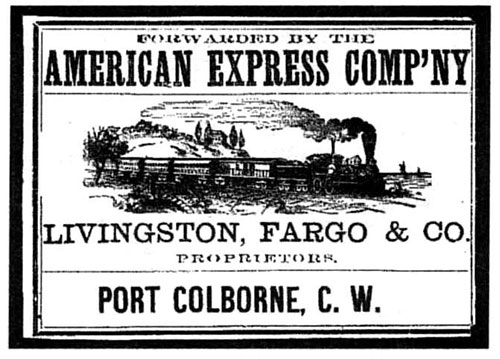

American Express originally competed with the U.S. Postal Service

Much like Wells Fargo, American Express got its start thanks to two guys named Wells and Fargo. In fact, they were the same two guys, and there was a third guy named Butterfield.

Henry Wells, William G. Fargo, and John Butterfield were active in the fast-moving express mail service, with Wells and Fargo often competing against Butterfield. They eventually decided to join forces, forming American Express in Buffalo, New York, back in 1850.

“The express companies served as a lifeline to the growing nation. Intrepid express men, typically on horseback or driving stagecoaches, traversed from the eastern cities to the western frontier, transporting correspondence, parcels, freight, gold and currency, among countless other goods,” the company writes in an article about its history. “American Express quickly earned a reputation as the best in the fledgling industry—the company that delivered, literally.”

(Wells and Fargo eventually started working on offering banking services to the then-budding California market, and that bank became nearly as iconic.)

So how did AMEX get associated with credit cards, anyway? Basically, they found their way to cards through some of their earliest financial offerings—the money order and the traveler’s check. These two products, which are considered as good as money in most places, eventually gave AMEX a pseudo-bank-like status—albeit one that for decades had significant interests in the travel industry—and by the time that Diners Club cards became a big deal, the credit card industry seemed like a natural fit for AMEX, which offered its own card in 1958.

The company’s reach in the travel market ensured that the card could be used in tens of thousands of places, and eventually the company became a massive conglomerate known for promoting an array of colorful cards—first gold, then platinum, then black, now blue.

Not bad for a company that started out as a mail service.

1966

The year that the first debit card was released—as a pilot program by the Bank of Delaware. This type of card started out slow, but picked up quickly thanks to the ATM, which gave the card a sense of purpose. Now, the card is far more popular than even the credit card, as it’s effectively made it possible for consumers to not have to walk around with money, ever.

To end off, a quick story: Last year, the mobile payments industry suffered from an embarrassing gaffe. A startup in the wireless industry was meant to bring mobile payments to the masses through near field communications, effectively replacing your wallet. It was an idea that was waiting for its moment.

There were a series of problems, however, but one was bigger than the rest: the mobile payments startup was named ISIS, and last September, the firm changed its name to the less-terroristy Softcard.

Unfortunately for them, they decided to do so a week before Apple Pay came out. That was the beginning of the end, and back in March, the firm closed its doors entirely.

You can find one relic of this utter failure on eBay, where someone is selling an American Express Serve card with ISIS branding. The card literally says “Serve ISIS.”

“They told me to shred it or send it back for obvious reasons,” the eBay seller said. Instead, he’s asking for $1,500.

Sounds like someone needs to pay off a credit card.

:format(jpeg)/2018/04/gn45jgb5aktrl7n019pf--1-.gif)

/2018/04/gn45jgb5aktrl7n019pf--1-.gif)

/uploads/ernie_crop.jpg)