Today in Tedium: Why do prices on new products always seem to be so consistent in advertising, yet when you actually go shopping, the prices can fall apart because of inflation or market demand? The GPU industry of a year ago is a good example of this situation in action—where demand so outstrips supply that the manufacturer’s suggested retail price is basically meaningless. Ah yes, the manufacturer’s suggested retail price, or MSRP—it’s the primary way that manufacturers can leave their mark on a product after it leaves its hands and goes to a retailer. Depending on the product and the use case, it can be a ceiling or a floor—and when used carefully, it can be one of the strongest weapons retailers have in terms of building profitability . Today’s Tedium dives into the concept of MSRP, why it’s not price fixing, and how it can change your perception of a product’s value. — Ernie @ Tedium

Today’s GIF comes from a Kentucky furniture store commercial from the ’90s.

Find your next favorite newsletter with The Sample

Each morning, The Sample sends you one article from a random blog or newsletter that matches up with your interests. When you get one you like, you can subscribe to the writer with one click. Sign up over this way.

Today’s Tedium is sponsored by The Sample. (See yourself here?)

An ad for Dr. Miles, the company whose medicine helped to set the stage for MSRP. (The Indianapolis Star/Newspapers.com)

Where did the concept of an MSRP come from, anyway?

The Sherman Antitrust Act of 1890 is one of the most important laws in the grand discussion of free trade, an attempt to limit artificial scarcity through price fixing.

In its wake, you couldn’t force people selling your product to set a specific price for your product.

But it took a case at the Supreme Court to take the teeth out of fixed prices, gradually turning them into suggestions. That case was Dr. Miles Medical Co. v. John D. Park & Sons Co., a 1911 ruling that tested limitations on price controls introduced with Sherman, ultimately found that a manufacturer of a product (in the case of Dr. Miles, patent medicine) could not enforce price limitations on the brands that sold its products. This case came about because John D. Park & Sons Co. was selling Dr. Miles’ drugs at a discount, deeply undercutting other retailers.

The court ultimately sided with the retailer, with Supreme Court Chief Justice Charles Evans Hughes writing:

The complainant’s plan falls within the principle which condemns contracts of this class. It, in effect, creates a combination for the prohibited purposes. No distinction can properly be made by reason of the particular character of the commodity in question. It is not entitled to special privilege or immunity. It is an article of commerce and the rules concerning the freedom of trade must be held to apply to it. Nor does the fact that the margin of freedom is reduced by the control of production make the protection of what remains, in such a case, a negligible matter. And where commodities have passed into the channels of trade and are owned by dealers, the validity of agreements to prevent competition and to maintain prices is not to be determined by the circumstance whether they were produced by several manufacturers or by one, or whether they were previously owned by one or by many. The complainant having sold its product at prices satisfactory to itself, the public is entitled to whatever advantage may be derived from competition in the subsequent traffic.

In many ways, the case helped to set the tone for the modern discount store. With companies no longer able to mandate specific prices, retailers suddenly had the space to discount hot products at will.

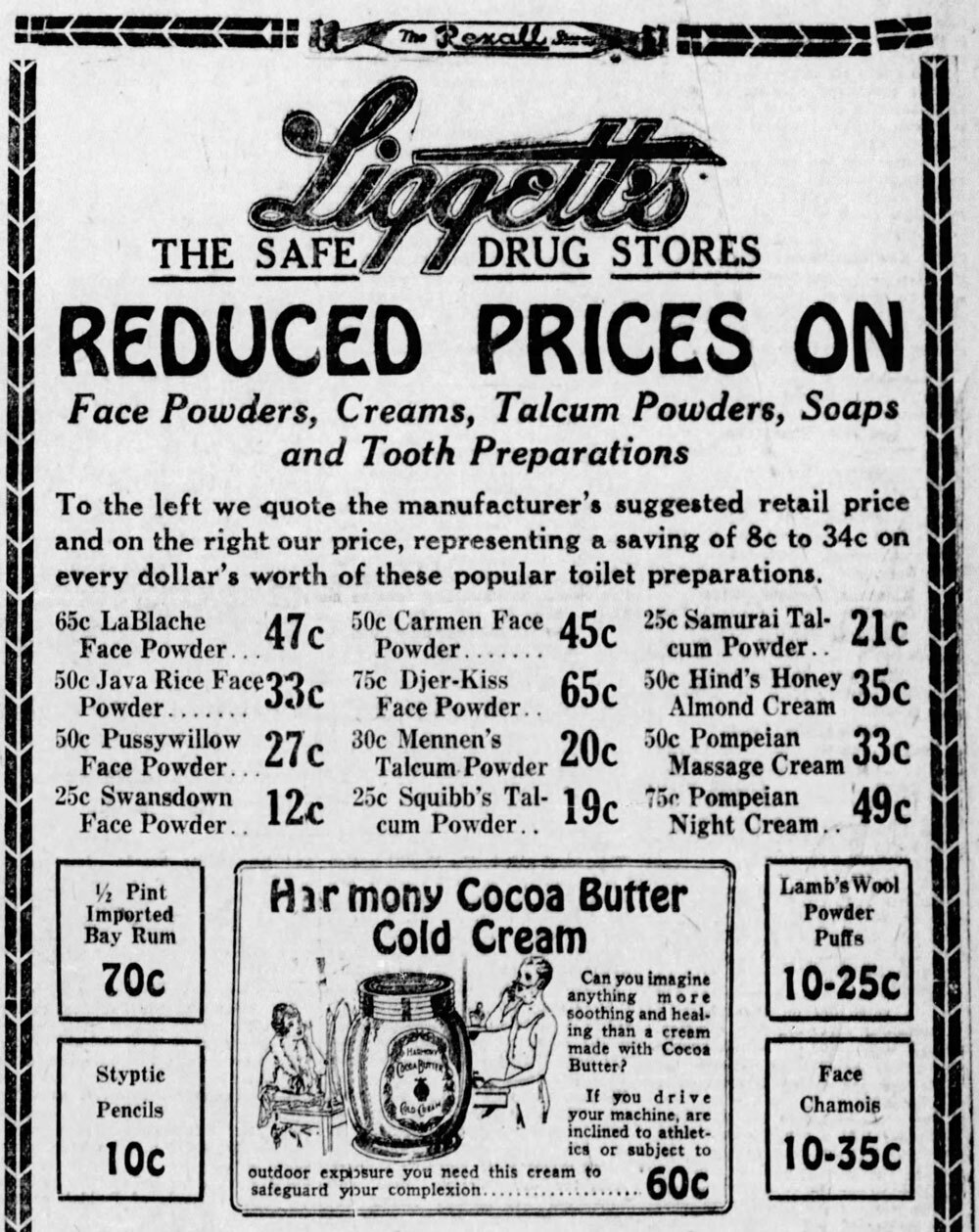

One of the first examples I could find of a store specifically promoting its prices compared to MSRP. (Star-Tribune/Newspapers.com)

It wasn’t long after the Dr. Miles ruling that terminology speaking to this shift started appearing in newspapers nationwide—the manufacturer’s suggested retail price, later shortened to MSRP. (The earliest example I can find comes from 1918, an advertisement for the drug store Liggett’s.) The SCOTUS decision didn’t set the terminology—the manufacturers did.

Just imagine any company whose products you bought because they were a few cents cheaper, and the standards that needed to be put in place to allow for that.

The use of the phrasing, though slow in initial uptake, quickly meant it would become the common term very soon after. This is shown by the fact that the Tariff Act of 1930, a law that set fines for counterfeit goods, actually codified the concept of MSRP in the law. From the law:

For the first such seizure, the fine shall be not more than the value that the merchandise would have had if it were genuine, according to the manufacturer’s suggested retail price, determined under regulations promulgated by the Secretary.

For the second seizure and thereafter, the fine shall be not more than twice the value that the merchandise would have had if it were genuine, as determined under regulations promulgated by the Secretary.

In a way, this law gave the MSRP significant value that Dr. Miles arguably took away. While it was not quite the same tool as a set price, having it meant that when fines were handed down in counterfeit cases, MSRP could shape how the product was protected by regulators. In a way, it almost encouraged a high MSRP, no matter how the object was actually sold at retail, because having a high suggested price threatened counterfeiters.

While Dr. Miles was effectively overturned in a 2007 Supreme Court case, Leegin Creative Leather Products, Inc. v. PSKS, Inc., which required “vertical price restraints are to be judged by the rule of reason,” the ruling didn’t end up killing the MSRP. How could it? The concept was too valuable to retailers, who got a lot out of it.

Let’s Talk Terms

MSRP

The manufacturer’s suggested retail price, or MSRP, is the term used for prices suggested by manufacturers to retailers, who pay wholesale prices but get a degree of markup from those prices. In the modern day, MSRP is often ignored by retailers in favor of their own pricing approach.

MAP

The minimum advertised price, a floor for how much a product can be advertised as selling for, which has gained traction as an alternative to MSRP. While retailers can continue to sell below that price, they can’t advertise the discounted price, limiting the upside from a marketing standpoint. This practice, called resale price maintenance in the United Kingdom, is generally seen as illegal there.

MRP

The maximum retail price, an alternate approach to MSRP used in India and Bangladesh in an effort to prevent price gouging. This system, unlike MSRP, is enforced by law, which has made it somewhat controversial and a frequent subject of debate in the country. The price has to be listed on the packaging, making it hard to get past—and in some circles it’s seen as a state-sanctioned free market limitation.

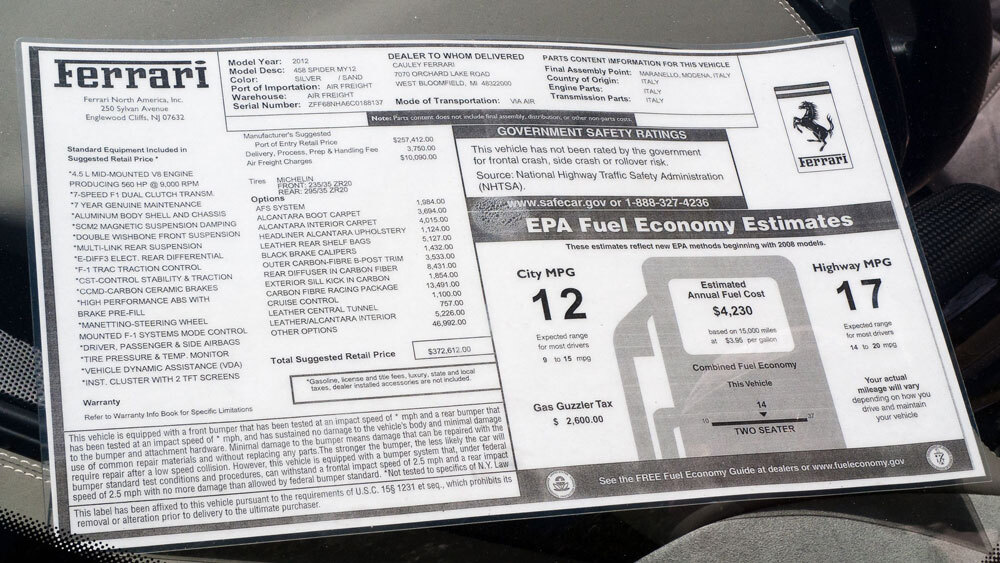

A (very expensive) example of a Monroney sticker, on a 2012 Ferrari 458 Spyder. Hope you’re good at haggling. (Mustang Joe/Flickr)

The Monroney Sticker: The giant sticker that made MSRP famous—and the senator that it’s named after

If you’ve ever gone to a dealership and taken a look at a new car, you’ve likely seen the giant sticker in the window, full of basically every significant detail about the vehicle—including, most notably, the MSRP of the vehicle.

That sticker is there to arm you with ammo about one of the most expensive products you’re likely to buy in your lifetime.

And it’s named after a guy named Monroney—he’s the guy who passed the law to require that sticker be there.

Almer Stillwell “Mike” Monroney, a Democrat from Oklahoma, served three terms in the Senate, with the Automobile Information Disclosure Act of 1958, one of his most prominent pieces of legislation, reflecting his interest in transportation issues. (Also in 1958, he wrote and sponsored the Federal Aviation Act, which gave us the Federal Aviation Administration. 1958 was a big year for him.)

Now, about the Automobile Information Disclosure Act—that was a bill that aimed to rein in deceptive practices on the part of dealers, who tend to have the upper hand in many car negotiations because they know more about the vehicles and how much they cost than you do. Records, both of the time and in retrospective form, imply that Monroney was passionate about the cause.

Mike Monroney, the liberal senator from Oklahoma who sold the auto industry on informational stickers. (Oklahoma Historical Society)

As a 2008 New York Times retrospective piece explained, Monroney (who also used his position to support civil rights causes) wasn’t trying to screw over the auto industry, but simply wanted people to have all the information they could get about the cars they were buying. Monroney, a former journalist, fittingly wanted a little sunlight on the process of buying a car.

“Although I am not wedded to the wording of the bill, I firmly believe that there should be a windshield sticker disclosing to the customer in detail what the factory suggests as a retail price for the car and accessories together with the cost of transportation and other pertinent information,” he said, according to Congressional records. “This would do much to restore public confidence in automobile marketing, which has deteriorated into the world’s greatest guessing game.”

Despite what might have sounded like a nightmare to the car industry, automakers ended up standing behind the cause, seeing an opportunity to bolster the image of car dealers.

“There’s too much misinformation about pricing in the automobile industry today,” said Texas-based dealer Thomas W. Abbott, who spoke in a Senate Commerce subcommittee hearing on behalf of the National Automobile Dealers Association. “The customer must have confidence in the price of the automobile he buys.”

So, the law passed, ensuring that Monroney has a direct imprint on every new car sold in the United States to this day—complete with MSRP. In many ways, what he did at the time was a big win for consumer rights. Nowadays, transparency is a big part of buying a car, because unlike the 1950s, information about vehicles is easily available from a variety of sources.

Not a bad legacy.

$200

The cost, per kilo, of Pop Rocks in at least one case on the black market in 1978. This cost well outpaced the MSRP for Pop Rocks, according to The New York Times, which reported a cost of of the sparkly candy reaching as much as $200 a kilogram, or (based on the 0.17-once size of a single packet of Pop Rocks) 96 cents a pack. That’s nearly five times the 20-cent MSRP of the era. All of this is to say: When demand for a product is high, the “suggestion” part of the MSRP loses a whole lot of weight.

(Roadsidepictures/Flickr)

Why MSRP is often used as a strategy to play on consumer emotions

So if MSRP isn’t technically necessary anymore thanks to a Supreme Court ruling, why is it still everywhere?

I think in a lot of ways, while the frustrations created by an inability to control pricing are real, so were the benefits for retailers, who quickly figured out that by giving consumers a choice as to how much a product sold for, it gave them significant options for attracting consumers.

Entire types of companies, such as Costco, wouldn’t exist unless MSRP could be easily ignored, its capability to allow consumers to realize they’re getting a discount used as a surgical tool to get people to make a certain decision.

This is not like old-school retail economics, either. A post on the Shopify blog from just last fall, explaining retail psychology techniques, had this to say about MSRP:

Manufacturers usually set a manufacturer’s suggested retail price, or MSRP, for items that will be sold across many different ecommerce or retail stores. This is the price you’ll often see on a standard price tag for a book or car. Some businesses may choose to sell right at the MSRP, but others show the MSRP next to the lower price they’re selling the item for. This is a tactic commonly used in outlet stores. A shop might run a 40%-off the MSRP sale and offer an extra 30% off certain items, so a purse listed at $298 MSRP ends up costing $54 instead.

The business uses the MSRP as an anchor to make customers feel like they’ve actually saved money on an item. For ecommerce shops, the MSRP might be crossed out with the new price next to it, a similar signal of savings.

This exact tactic is the very one that was used in the first ad I found that promoted MSRP prices back in 1918.

Messing with MSRP to help highlight value is but one trick in the retail psychology playbook. Another one is the concept of “goldilocks pricing,” in which different products have different features that ultimate push a consumer in a specific direction.

Apple is king of this type of positioning, and the recently released M2 MacBook Pro is a great example of this. The device, which only got a modest spec bump from its prior version, is clearly designed to either push consumers to the fanless MacBook Air, which has more features for roughly the same price, or the 14-inch MacBook Pro, which looks like a better deal the second you try to bump the specs on the 13-inch model. The 13-inch model exists to convince you to buy one of the other two models, which are ultimately more valuable to Apple in the long run.

And by putting in a high-end “anchor” product that most people won’t splurge for—say, a high-end meat like lobster or wagyu beef—can help to make the rest of your menu look reasonably priced in comparison.

Small things you don’t even think about—like pricing an object starting with an 7 or 8—can imply a deep discount, while the most obvious example—pricing something at $9.99 instead of $10—is believed to have the effect of driving sales.

So to put this all another way, MSRP ain’t going anywhere because it’s too valuable to both retailers, who attract people to their stores, and to manufacturers, who sell more items and make more money when retailers actively ignore the MSRP.

So, going back to the discussion on GPUs, it was for many years in a Pop Rocks position—where the demand for the product so clearly outstripped supply that it created price hikes so high that the MSRP technique didn’t really work anymore.

A commercial for Pop Rocks, just because.

And now that crypto miners have gotten sick of mining with GPUs, now prices have sunk back to normal, and then some. According to Tom’s Hardware, it is now possible to get high-end graphics cards at retail for as much as 30 percent below MSRP, a level that suggests that even the traditional approach of cutting prices below MSRP is more aggressive than it usually is.

Which suggests that the real value of MSRP, a tool manufacturers didn’t want retail to have but ultimately made retail better for both stores and consumers, has a limit.

If the market is broken, it doesn’t matter what the manufacturer suggests—it’s not anywhere close to reality.

--

Find this one an interesting read? Share it with a pal!

And thanks to The Sample for giving us a push. Subscribe over this way.