Today in Tedium: You know how Apple holds itself up as a paragon of privacy these days, taking steps to protect your data and your phone from bad people? There’s a problem with that mindset: Its App Store, by design, undercuts that argument. The pricing structure is designed in a way that encourages game-makers to use advertising and data brokering to pay for itself, while leading to services that are unsustainable unless they specifically violate your trust. The best alternative we have to this is the subscription model, which at least gives app developers a different motivation. Of course, anything in the wrong hands can have its problem—and the subscription model, particularly in the hands of ’90s infomercial culture, is a great example of this. Today’s Tedium highlights infomercial schemes, and the parallels they share with our app-heavy culture. — Ernie @ Tedium

Keep Us Moving! Tedium takes a lot of time to work on and snark wise about. If you want to help us out, we have a Patreon page where you can donate. Keep the issues coming!

We accept advertising, too! Check out this page to learn more.

1949

The year the first purported infomercial appeared on television, an advertisement for a Vitamix blender. The commercial, featuring William G. “Papa” Barnard, is a fascinating watch, because Barnard is a solid pitchman who’s trying to sell the world on healthy eating. But while the infomercial, which didn’t use that exact name, was early, it wasn’t followed up with a lot of others for decades because of Federal Communications Commission rules that initially limited the amount of advertising that could appear on a station in an hour. The modern infomercial format came to life in the late 1970s, and was explicitly laid out as an advertising option for the QUBE interactive television system, an early form of cable TV.

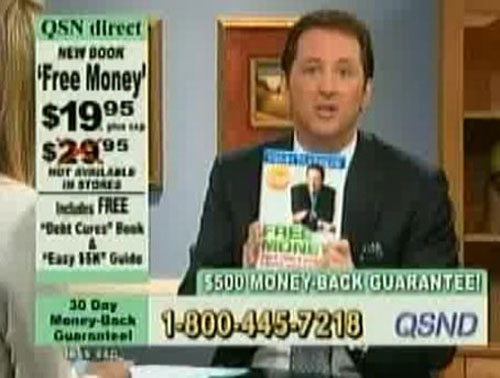

Notorious infomercial swindler Kevin Trudeau.

Five times people went to prison for selling fraudulent stuff on television

- Kevin Trudeau, perhaps the most infamous infomercial icon, has been selling fake cures that the unnamed “they” didn’t want to tell you about for decades, using an array of scummy behaviors that led to a 10-year federal prison sentence and a whole section on the Federal Trade Commission website dedicated to refunding consumers bilked by the infomercial king. Despite that, Trudeau spent a while appealing like crazy, and maintains his supporters in some parts of the world, including on a website we’re definitely not going to link.

- Steve Warshak, the mastermind of a certain herbal supplement for men whose name we will not say out of fear of not hitting your inbox, made a lot of bold claims with his company’s commercials, featuring an actor memorably nicknamed “Smilin’ Bob,” but ultimately went to prison for nearly a decade—his sentence reduced from 25 years—after it became clear that the company used deceptive practices to auto-ship the pills to consumers.

- Don Lapre, an infomercial pitchman whose questionable infomercial-sold business plans earned him a Saturday Night Live parody in the ’90s, died in federal custody while awaiting trial. Lapre was said to have defrauded his roughly 220,000 victims by nearly $52 million.

- Wade Cook, a purported financial guru, sold his get-rich-quick schemes on infomercials and in mainstream bookstores for years, despite the fact that his personal history included multiple bankruptcies. Cook eventually went to prison on fraud chages, and when he got out in 2015 … he started selling his get-rich-quick schemes again.

- Robert “Larry” Lytle, the creator of a purported laser-based cure-all device called the QLaser, was recently sentenced to 12 years in prison for fraud after repeatedly marketing his device using fraudulent claims. Lytle had been selling QLasers since 1997, a year before he lost his dentistry license in South Dakota for making such claims as creating a device that could repair damaged DNA, cure cancer, and stop HIV. You know, low-level stuff.

$150M

The amount the Psychic Friends Network, an infomercial empire led by marketer Michael Warren Lasky, was estimated to have earned in 1995, according to The New York Times. Lasky’s selling of the public on infomercial psychics—with Dionne Warwick at the center—never hid the fact it was a play to get people to part with their money. “It’s pure capitalism,” Lasky said of his work. “In a free society, the ones who are the best survive. The best make the most money.” Just a few years later, bankruptcy and legal problems would catch up to Lasky.

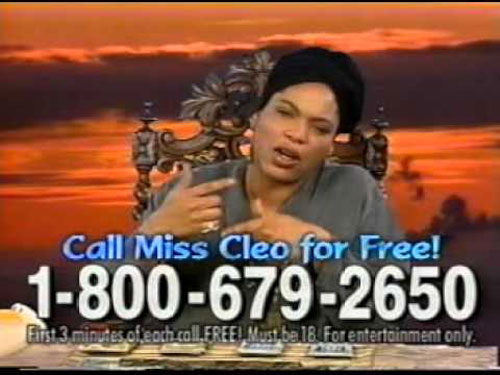

Miss Cleo once faced a subpoena for her birth certificate. Really.

How Miss Cleo highlights the great sketchiness behind many infomercial schemes

In the late 1990s, the work of Youree Dell Harris was hard to miss on television. While you were busy watching the Prevue Guide, waiting for your next show, an ad for her services would likely appear.

You probably know Harris under her “stage name,” if you could call an infomercial moniker that: She was Miss Cleo, an actress whose most famous role was as a television psychic.

Harris was a spectacular invention of an industry that had seemingly no standards, the face of a modest infomercial empire of phone services that promised to tell you the future. But even if she wasn’t a psychic, she had to have known that the Federal Trade Commission and other investigative bodies would eventually come calling.

And call they did. But let’s take a step back and appreciate the fact that people cared about Miss Cleo because her schtick made for really awesome television. Here was a woman with tarot cards and a lot of attitude promising to tell you about the future, and she was genuinely entertaining.

The problem? She used her talent in the name of fraud—a fraud worth as much as half a billion dollars to her employer when all was said and done.

“Ask me a question and I’ll tell you the truth, I can promise you that, baby,” she stated at the start of one 2001 infomercial that actually starred a real radio station morning crew. (The only thing that was real about the infomercial, of course, was the morning crew.)

Not long before she started showing up on television, Harris’ Cleo character, or a version of it, appeared on stage in Seattle. Harris, born in Los Angeles, was a playwright and actress whose best-known character first appeared in a play she wrote titled “For Women Only.” But the real drama took place behind the scenes: The Langston Hughes Cultural Arts Center gave Harris a budget to pay the cast and crew, according to the Seattle Post-Intelligencer, but she failed to distribute it to the crew. The cultural arts center considered suing her, but since the loss was relatively small at just a few thousand dollars, they decided not to pursue it further.

Harris skipped town and took Cleo with her—and started appearing on television in the character a year or two later, the “face” of the Psychic Readers Network (not to be confused with the Psychic Friends Network). Few people who saw the infomercials were aware of her past—or the fact that she wasn’t actually from Jamaica, but Los Angeles.

That wasn’t the only trick the commercials pulled, of course. The commercials promised a free psychic reading from a 1-800 number, but in many cases, the calls were being directly forwarded from a toll-free number to a 1-900 line, without the phone user knowing any the wiser.

If Miss Cleo got a hold of your credit card number, she was going for the kill—not a single modest charge, but multiple monthly charges, each far larger than the one that got you hooked in the first place. It wasn’t long before people started asking questions.

First up: Is “Miss Cleo” actually Jamaican? In early 2002, the state of Florida actually filed a subpoena for Cleo’s birth certificate to prove her identity and nationality. Because, unlike us, the average Joe had no idea that Miss Cleo was an actress from Los Angeles named Youree Dell Harris.

“That’s important because the whole concept of Miss Cleo is premised on her being a shaman from Jamaica,” Assistant Attorney General Dave Aronberg told the South Florida Sun-Sentinel that year. “If she’s from the Bronx instead, that would be a fraud.”

As that data point was uncovered, the whole thing quickly started to topple over, with the Federal Trade Commission getting a preliminary injunction against Harris’ employers, Access Resource Services, Inc. and Psychic Readers Network. By the end of 2002, the company had agreed to pay back $500 million in charges to consumers as part of a deal with the FTC and a number of states—a sweet deal, given that they had made a billion dollars off the scheme, and got to keep half of it.

Harris herself wasn’t charged and later admitted that she saw little of the money herself—and before her death in 2016, found other work banking off her years of solid character acting, though she frequently ran into problems with her former employer getting overly protective of the brand they built.

Most notably, she appeared as a Miss Cleo-like character in Grand Theft Auto: Vice City, a game that came out in 2002 but became the surprising target of a lawsuit just last year after the Psychic Readers Network claimed they had only heard about her presence in one of the most popular video games of the 21st century in her obituaries. Skeptical? So were a bunch of lawyers.

But then again, it’s probably par for the course for a company built on a giant fraudulent scheme.

And many infomercial schemes worked just like this: They hit you with flash—and Miss Cleo, who I saw described as a ”beloved con artist” during my research, was very much flashy—while trying to pull one over on you. Just like many modern-day mobile apps.

“It was one of the few jobs that seemed legitimate (I use that word loosely). It didn’t require me to pay for my own training, like the ‘medical transcription’ gigs I read about. And with Miss Cleo, I’d make my state’s minimum wage of $7.25 an hour. Considering that I did not have to get dressed or leave my apartment, it seemed like the perfect opportunity.”

— Amber Brooks, a writer for Refinery29, discussing her time working from home as a phone psychic for Miss Cleo. She noted that she was expected to keep people on the phone for at least 24 minutes at a cost of as much as $4.95 per minute, that many of the people who called were elderly and facing serious problems, and that she felt very guilty about the work, which led her to quit. “Some of these people clearly called once or twice a week—if not more,” she recalled. “I couldn’t help but do the math and think about the huge amount of money they were wasting.”

In a lot of ways, the modern app-store ecosystem shares much in common with the televised grift that many vintage infomercials specialized in. The difference, of course, is scale and intent.

You may be familiar with the term “dark patterns,” which refers to commercial tricks used to get you to sign up for or buy things you didn’t actually want, or give away things you didn’t intend to. Say, for example, the game that tricks you into clicking yet another ad, or the app that acquires a little bit more of your data because it convinced you to put in your birthday.

These kinds of swindles are well-known in infomercial lore, and were often a driving factor behind modern consumer advocacy efforts. Columbia House, for example, was infamous for sending you albums you didn’t want after you agreed to that “12 CDs for a penny” deal, a scheme called “negative option marketing.”

And years later, the Video Professor (whose founder I actually interviewed in 2016) gained a negative reputation for doing the same thing, though charging much more for lessons on eBay and Microsoft Office.

Even more innocuous infomercials, like the ads for My Pillow, have gotten dinged by the Federal Trade Commission for making false claims. (Fortunately, there’s only so much damage a pillow can do.)

The thing about app schemes is that the deceptions are often less obvious or less serious, meaning that when we’re actually deceived, we don’t feel nearly as distraught over the dark pattern—and are less likely to notice.

It’s a small lie, rather than a big one. The costs are often time or data, rather than money. That stuff is still valuable, and in the case of data, can be resold at a profit. But the tactics, the small tricks that get us to buy into the scheme, are often quite similar to what infomercial schemes might pull.

Think about it: What’s the difference between couching a line about auto-renewals behind a line about contraceptives, as a certain herbal supplement for men with a smiling mascot did, and hiding an armor upgrade behind a requirement that you log into Facebook, as numerous games might?

Just because one is working in “loot” and the other is working in actual dollar value doesn’t hide the fact that both are trying to pull one over on you, just like Miss Cleo was.

The motivations of the digital economy are screwed up, and you don’t need any tarot cards to uncover that.